Technology

FIX API Overview

FIX API is a proven, decades old method of connecting markets. We have created our own that connects all of the major cryptocurrency exchanges. FIX is widely adopted & much faster

The Financial Information eXchange (FIX) protocol is an open standard designed for real-time electronic communication in the financial sector. It was developed to provide a universal standard for exchanging trading information, allowing for seamless and secure interactions between various financial entities.

Architecture and Design

Protocol Layers

The FIX protocol is structured into multiple layers, each serving a specific function. These include:

- Session Layer. Manages the establishment, maintenance, and termination of a communication session.

- Application Layer. Handles the actual exchange of trading messages and data.

Message Structure

FIX messages consist of a header, body, and trailer, encapsulating various data fields such as order details, execution reports, and market data. This structured approach ensures that the communication is precise and unambiguous.

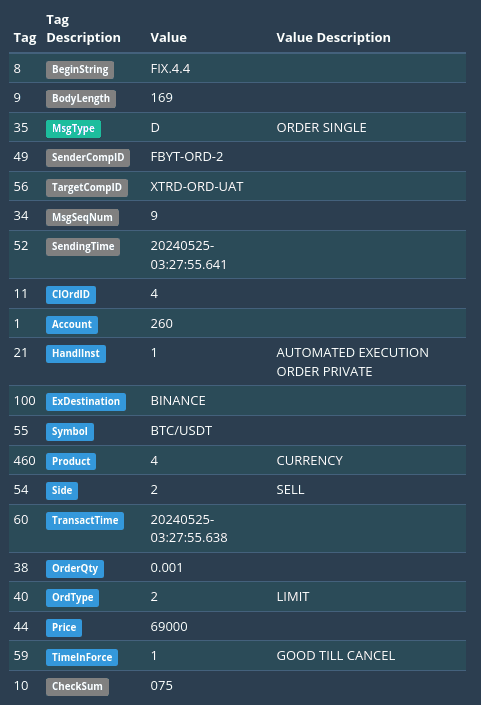

Tag System

FIX works by defining preset “tags” as value placeholders. Messages are entered by defining variables in the tags. For example, the value for the “side” of the trade can be a 1 for Buy or 2 for Sell in Tag 54.

Below is an example of a raw FIX message to place a Limit Buy order on Binance:

UAT34[]952[]20240525-03:27:55.64111[]41[]26021[]110

0[]BINANCE55[]BTCUSDT460[]454[]260[]20240525-03

:27:55.63838[]0.00140[]244[]6900059[]110[]075 223

Here is the same message in a more human-readable format:

Core Features

Standardization

FIX API's adherence to industry standards ensures interoperability between different systems and platforms. This standardization facilitates integration and reduces the complexity of connecting disparate systems.

Real-Time Data Exchange

FIX protocol supports real-time data exchange, enabling instant transmission of orders, confirmations, market data, and news. This real-time capability is essential for high-frequency trading and timely decision-making.

Customizable Fields

While FIX is standardized, it allows for customization through user-defined fields. This flexibility enables firms to tailor the protocol to meet their specific business needs without compromising on standardization.

Security and Compliance

Encryption and Authentication

FIX API employs robust encryption and authentication mechanisms to ensure the security of data transmitted over the network. These security features protect against unauthorized access and data breaches.

Regulatory Compliance

FIX protocol supports various regulatory requirements by providing detailed audit trails and comprehensive reporting capabilities. This compliance ensures that trading activities adhere to industry regulations.

Advantages of FIX API

Efficiency and Speed

FIX API offers low-latency communication, which is critical for time-sensitive trading activities. Its efficient message exchange process reduces the time taken for order execution and confirmation.

Reliability

The protocol's design ensures high reliability and uptime, which is crucial for maintaining continuous trading operations. FIX API's robust error-handling mechanisms further enhance its reliability.

Scalability

FIX API can handle a high volume of transactions, making it suitable for both small firms and large financial institutions. Its scalable architecture ensures that it can grow with the needs of the business.