Feature

Real-time Normalized Market Data

Axon Trade offers access to real-time normalized and optimized digital asset market data from 30+ major exchanges including Binance, Coinbase Pro, OKX, and more

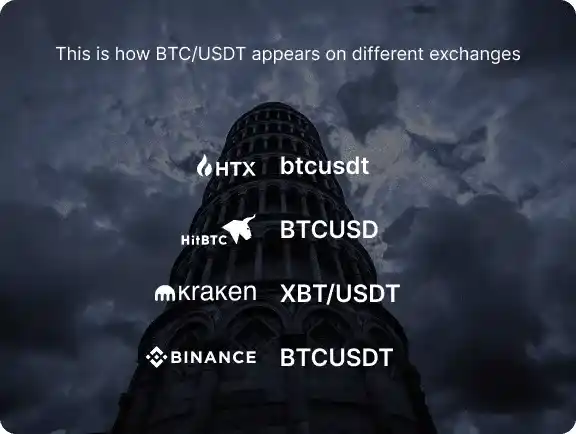

Normalized symbology

First and foremost, Axon Trade’s data is normalized, meaning that it is presented in a consistent format across all exchanges. This allows traders to compare prices and trends across different markets without the need for laborious data transformation.

Axon Trade sources data from major digital asset exchanges such as Binance, Coinbase Pro, OKX, ByBit, Deribit, Huobi, Kraken, and many others. No matter what markets you trade – spot, futures, options, perpetual swaps – you can consume all of these from Axon Trade.

See supported exchanges >Data formats

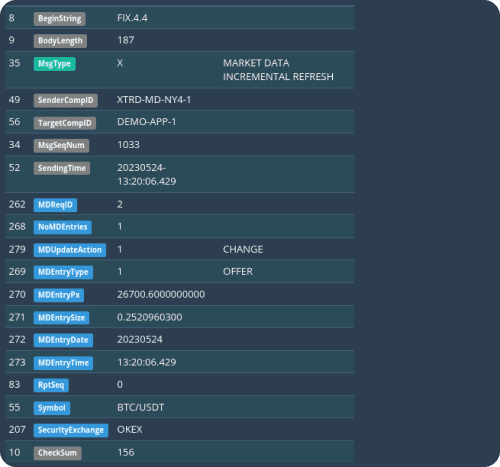

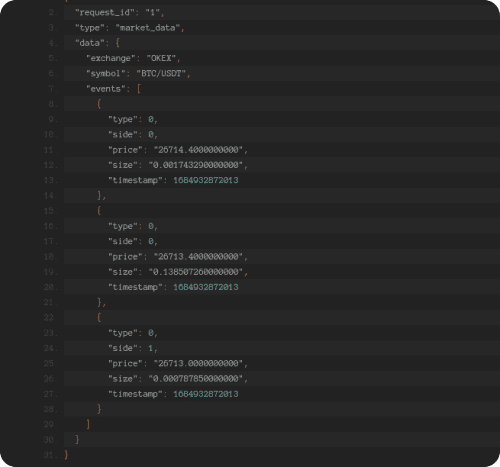

Axon Trade provides full order book information (called L2) and time and sales (Trades). As of today, we support two market data distribution channels - FIX 4.4 and WebSockets. See both data formats below (Axon Trade on the left, WebSockets on the right).

Axon Trade

This format follows the FIX 4.4 protocol, providing detailed L2 incremental book update. Key fields include liquidity provider and symbol names, update type, price, size, and timestamp.

WebSockets

This format uses JSON to deliver market data information via WebSockets, providing detailed L2 incremental book update. Key fields include liquidity provider and symbol names, update type, price, size, and timestamp.

Use cases

Axon Trade’s crypto market data can be used in a variety of applications, including but not limited to the below-listed fields.

Market Analysis

Actionable insights for informed market analysis

Trading and Execution

Data-driven trading and execution strategies with precise information

Risk Management

Market insights for proactive risk mitigation

Algorithmic trading

Automated strategies with timely insights and execution precision

Market Research

In-depth market research through reliable market data

Portfolio Management

Investment decisions with market intelligence and risk assessment

Contact us for more info