February 12, 2025

Improving Cryptocurrency Predictions with RNN Models

Introduction

Cryptocurrency markets are known for their significant price fluctuations, which present both opportunities and risks for traders. Predicting these price movements is a complex task, as cryptocurrencies are influenced by various factors, including market sentiment, network activity, and external events. To address this challenge, traders need tools capable of analyzing sequential data and uncovering meaningful patterns.

Recurrent Neural Networks (RNNs) are designed to process time-series data, making them an effective approach for cryptocurrency price forecasting. By handling relationships across data points over time, RNNs excel at capturing trends and dependencies that traditional models often miss.

This article is based on the research titled Utilizing RNN for Real-time Cryptocurrency Price Prediction and Trading Strategy Optimization, which evaluates the use of RNN models such as Long Short-Term Memory (LSTM), Gated Recurrent Unit (GRU), and Bidirectional LSTM (Bi-LSTM) for predicting the prices of Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). The study compares their performance across different scenarios, showcasing their strengths in accuracy and adaptability.

In this article, we will examine the methodology, results, and real-world applications of these models, providing insights for traders and analysts looking to refine their strategies in a rapidly evolving market.

The Case for RNN Models in Cryptocurrency

Traditional approaches to predicting cryptocurrency prices, such as linear regression or ARIMA, often struggle to handle the complexities of financial time-series data. Cryptocurrencies are highly volatile and influenced by non-linear factors, making it difficult for these models to accurately forecast price movements. This is where Recurrent Neural Networks (RNNs) offer a significant advantage.

RNN models, particularly Long Short-Term Memory (LSTM), Gated Recurrent Unit (GRU), and Bidirectional LSTM (Bi-LSTM), are designed to process sequential data. Unlike traditional models, they can account for long-term dependencies and relationships across time steps, which is essential for understanding the trends in cryptocurrency markets. These capabilities allow RNNs to capture patterns that would otherwise be lost with simpler statistical methods.

Understanding the Models

LSTM

LSTM networks address the vanishing gradient problem, a common issue in traditional RNNs. They use memory cells to retain important information over longer sequences, making them highly effective for time-series forecasting.

Use Case: Predicting long-term price trends for assets like Bitcoin.

GRU

GRU is a simplified version of LSTM that reduces computational complexity while maintaining high performance. It is particularly well-suited for shorter sequences or real-time forecasting.

Use Case: Tracking short-term price changes in volatile markets.

Bi-LSTM

Bi-LSTM extends LSTM by processing input data in both forward and backward directions, allowing it to capture a broader range of dependencies.

Use Case: Analyzing market reversals and sudden price shifts.

Why RNNs Excel

RNNs excel in cryptocurrency prediction because they can:

Handle non-linear patterns inherent in market data.

Learn from past trends while accounting for recent changes.

Process high-frequency data without losing context.

By leveraging these strengths, RNNs offer a robust solution for forecasting cryptocurrency prices and optimizing trading strategies.

Model Training and Methodology

The success of RNN models in cryptocurrency price prediction relies on proper training and careful handling of data. This section outlines the methodology used to prepare the data and train the models, as well as the evaluation metrics applied to assess their performance.

Data Collection and Preprocessing

The researchers used historical price data from Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) to train the RNN models. Key steps included:

Data Sourcing: Data was obtained from reliable cryptocurrency exchanges to ensure accuracy.

Normalization: Features were scaled using MinMax scaling to ensure uniform input ranges, preventing dominance by larger numerical values.

Handling Missing Values: Gaps in the dataset were filled using interpolation to maintain continuity.

Feature Selection: Key variables such as open price, close price, high, low, and volume were included to provide a holistic view of market behavior.

Experimental Setup

The study employed a split of 80% for training and 20% for testing, ensuring robust model evaluation. To enhance the models' accuracy, hyperparameter tuning was performed to optimize aspects such as:

Learning Rate: Adjusted to balance convergence speed and stability.

Batch Size: Configured to process subsets of data during each training iteration.

Epochs: Determined to ensure adequate training without overfitting.

Hidden Units: Defined to balance model complexity and computational efficiency.

Evaluation Metrics

To measure the performance of each model (LSTM, GRU, Bi-LSTM), the following metrics were used:

Mean Squared Error (MSE): Evaluates the average squared difference between predicted and actual prices.

Mean Absolute Error (MAE): Reflects the average absolute difference between predictions and actual values.

Root Mean Squared Error (RMSE): Highlights larger errors more prominently, indicating model sensitivity.

Mean Absolute Percentage Error (MAPE): Represents error as a percentage, allowing for better interpretability across price ranges.

Training Process

Each RNN model was trained using historical data, with the goal of minimizing error metrics. Key findings during training included:

LSTM achieved stable convergence but required more epochs compared to GRU.

GRU trained faster and showed comparable accuracy in short-term predictions.

Bi-LSTM demonstrated strengths in handling both forward and backward dependencies, providing better results for datasets with high volatility.

Performance and Results

The effectiveness of RNN models in cryptocurrency price prediction hinges on their ability to process time-series data and adapt to various market conditions. This section evaluates the performance of the three RNN variants—LSTM, GRU, and Bi-LSTM—based on metrics and scenarios outlined in the research.

Comparative Performance

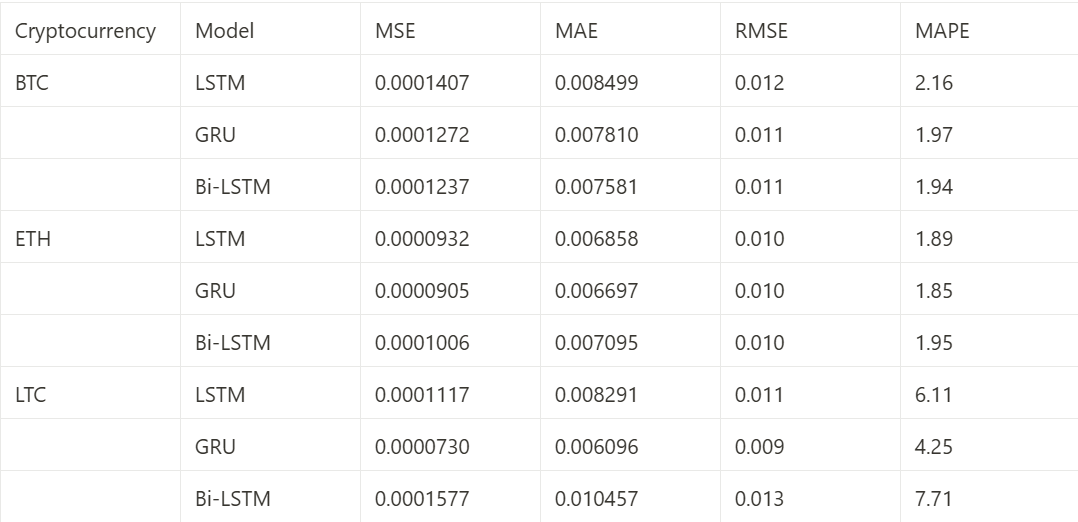

The study assessed model performance on historical data from Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), using key metrics such as MSE, MAE, RMSE, and MAPE. Here are the key findings:

LSTM: Demonstrated high accuracy for long-term trend predictions. However, its training time was longer compared to GRU due to the complexity of its architecture.

GRU: Offered faster convergence and performed well in short-term predictions. Its simplified structure makes it computationally efficient without sacrificing significant accuracy.

Bi-LSTM: Achieved the best results in capturing volatile price patterns by analyzing both forward and backward data sequences. This model performed particularly well in highly volatile markets like Bitcoin.

Key Metrics and Insights

The following metrics provided insights into the strengths and weaknesses of each model:

Market-Specific Results

Bitcoin (BTC): Bi-LSTM excelled in handling Bitcoin’s volatility, providing the most accurate forecasts for sharp price movements.

Ethereum (ETH): GRU performed slightly better due to its ability to converge quickly, aligning well with Ethereum’s moderately volatile patterns.

Litecoin (LTC): LSTM delivered stable long-term predictions, reflecting Litecoin’s less erratic price trends.

Model Convergence Patterns

Training convergence patterns showed that:

GRU displayed the lowest loss for ETH and LTC, reflecting its computational efficiency.

Bi-LSTM excelled for BTC due to its bidirectional approach.

Practical Takeaways

Use LSTM for long-term trend analysis in less volatile markets.

Opt for GRU when computational efficiency and quick predictions are priorities.

Choose Bi-LSTM for analyzing highly volatile assets or identifying intricate price patterns.

Conclusion

The integration of advanced RNN models into cryptocurrency trading offers traders a competitive advantage by providing accurate and timely predictions. This article, based on the research study Utilizing RNN for Real-time Cryptocurrency Price Prediction and Trading Strategy Optimization, has demonstrated the potential of models like LSTM, GRU, and Bi-LSTM to improve trading outcomes.

Key takeaways include:

Bi-LSTM’s effectiveness in volatile markets.

GRU’s speed and adaptability for short-term predictions.

LSTM’s strength in long-term trend forecasting.

While challenges like computational demands and data sensitivity remain, the ongoing refinement of RNN models points toward a promising future for their application in trading. Traders who integrate these models into their strategies can achieve deeper insights and better-informed decisions.

For more details and resources, refer to the GitHub repository associated with the research.

About Axon Trade

Axon Trade is an institutional-grade platform offering advanced solutions for digital asset trading. With features such as a unified FIX API for multi-exchange trading, real-time normalized market data, and robust order management capabilities, Axon Trade empowers traders to optimize their strategies in dynamic markets. For more information, visit Axon Trade.