June 28, 2019

How Institutional Investment Will Change the Crypto Asset Market

This article was originally published on Nasdaq.com.

By Alexander Kravets. He is the cofounder and CEO of Axon Trade, a technology company that is bringing mature Wall Street technologies to the world of cryptocurrency. Before Axon Trade he served as Managing Director of a self clearing broker/dealer that handled 4% of the daily trading volume on Nasdaq and successfully launched Sogotrade, a retail investing platform with over 100,000 clients.

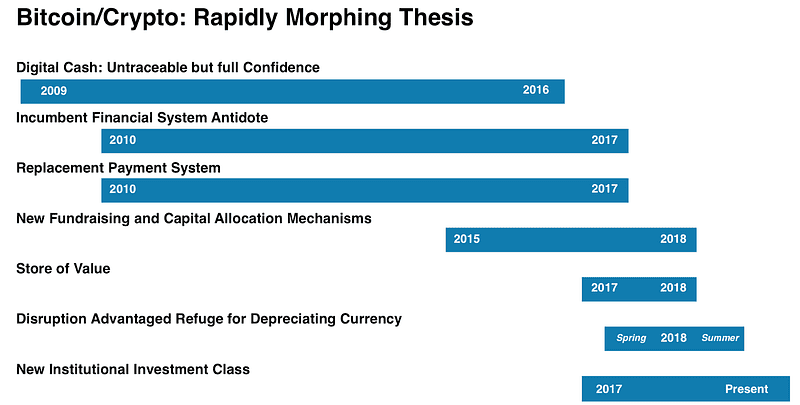

Institutional investment has long headlined as the gateway to widespread crypto adoption. Beginning with bitcoin in 2009, cryptocurrencies continue to evolve in response to investor preferences. Utility tokens, security tokens, and most recently stablecoins are all on offer in the crypto market. Regardless of the application, each of these token iterations aims to bridge the gap between digital and conventional finance.

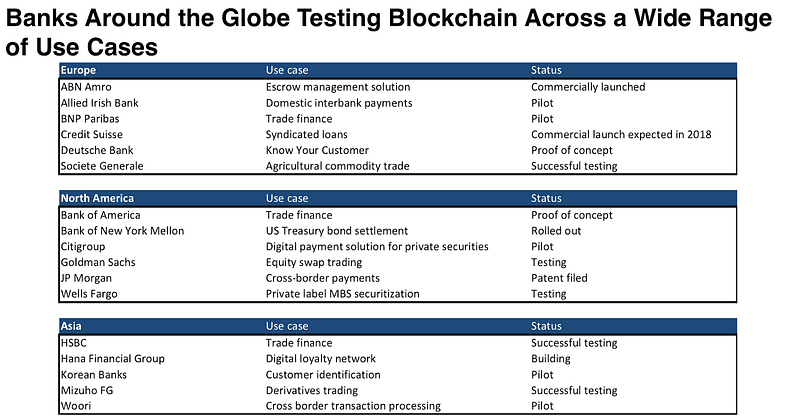

However, despite ongoing initiatives, the timing of institutional adoption has been mostly speculative — until now. Several recent developments in the industry suggest institutional investors are poised to enter the market in 2019. Despite the prolonged bear market of 2018, many large corporations are busy laying the groundwork necessary for institutional investment. Companies like Facebook, JP Morgan, Fidelity, MetLife, and IBM continue to make significant investments in blockchain initiatives.

Further, a survey conducted by Fidelity Investments found that 47% of institutional investors “appreciate that digital assets are an innovative technology play,” while 46% are attracted to their low correlation to other assets. Morgan Stanley has also pointed to an emerging awareness of crypto as an institutional investment class in recent years.

Source: Morgan Stanley — Update: Bitcoin, Cryptocurrencies and Blockchain

Although institutional adoption is on the horizon, not everyone sees it as a good thing. Let’s delve into the good and bad of institutional investment in the crypto market.

The Downside to Institutional Crypto Investment

Several stakeholders in the crypto ecosystem are resistant to the arrival of institutional investors; there are typically a few reasons for this.

Ideology

When bitcoin was first launched in 2009, Satoshi Nakamoto had a specific vision for the cryptocurrency. The intent was to reduce the involvement of the state and the institutional structures of our society. In the original whitepaper, complete decentralization was championed so that all the power was in the hands of the people, not “the system.” The Satoshi faithful perceive institutional involvement as an insult to the original ideology of cryptocurrency.

Censorship

The Overton window refers to the range of ideas that are permitted to be discussed in the public realm. Many argue that since the arrival of institutions in the crypto ecosystem, censorship has become prevalent on several topics. And although deleting unfavorable comments from a crypto subreddit can be attributed to those looking to protect their investment, the practice has allegedly gotten worse.

Recuperation

The Internet was intended to be free, open, anonymous, and decentralized. Instead, it is censored, controlled, tracked, and spied upon by governments and big tech companies. This scenario is an example of recuperation, meaning:

“…the process by which politically radical ideas and images are twisted, co-opted, absorbed, defused, incorporated, annexed and commodified within media culture and bourgeois society, and thus become interpreted through a neutralized, innocuous or more socially conventional perspective.”

Many believe that blockchain technology and cryptocurrency will be absorbed by institutional investors, dramatically altering its intended purpose.

The Benefits of Institutional Crypto Investment

Despite the arguments against institutional adoption, there are benefits for those that currently hold or intend to invest in crypto assets.

Lower Volatility

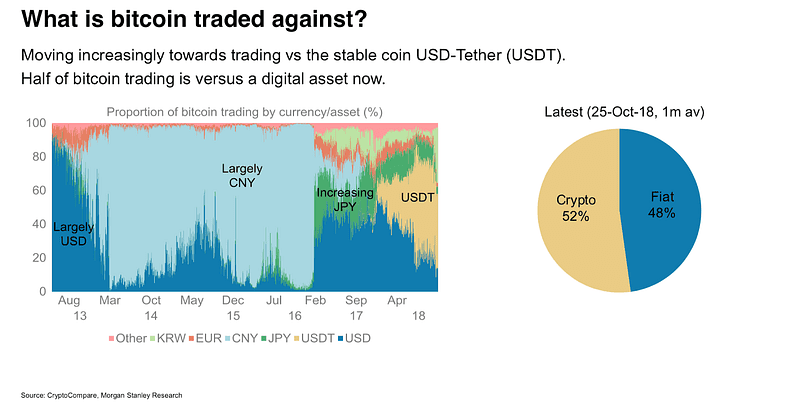

Those in support of institutional investment point to the stabilizing of crypto markets as a significant benefit. The idea is that as the demand for crypto increases, a more diverse investor pool will emerge, stabilizing markets. As the move towards stablecoins continues, institutional investors will also inherently increase their supply, further lessening potential volatility.

Source: Morgan Stanley — Update: Bitcoin, Cryptocurrencies and Blockchain

Increasing Returns

As institutional investors accumulate crypto assets, many with a finite supply, demand is expected to increase dramatically. In the long run, this increased demand and exposure will benefit early crypto adopters as prices rise substantially.

Balancing the Crypto Ecosystem

The institutional adoption of crypto assets is a complex undertaking. Although many are poised to benefit from increasing crypto demand and subsequent market exposure, several concerns remain. Those who support the founding ideology of bitcoin and other original cryptocurrencies remain leery of centralized institutions exploring the technology. And as many institutions explore blockchain and crypto, the possibility of recuperation is concerning for some.

Source: Morgan Stanley — Update: Bitcoin, Cryptocurrencies and Blockchain

As companies like JP Morgan and Facebook push forward with creating their cryptocurrencies, it’s unclear how such initiatives will affect the broader ecosystem. Many have already begun to argue that these digital tokens aren’t cryptocurrencies at all. Regardless of the semantics, it’s evident that digital currency is here to stay, and stakeholders hold diverse opinions. How will it all play out? It appears only time will tell.