January 2, 2025

Crypto Hedge Fund Industry Retrospective

2024 Highlights

Introduction

The crypto hedge fund sector has experienced unprecedented evolution in recent years. With significant regulatory advancements, heightened institutional interest, and the maturation of digital asset markets, the industry stands at a pivotal juncture. The 6th Annual Global Crypto Hedge Fund Report sheds light on the transformative developments that defined 2024. This analysis explores key trends, challenges, and actionable insights, serving as a valuable guide for decision-makers in trading and technology sectors.

From the growing prominence of derivatives trading to the burgeoning role of tokenization, hedge funds are adopting sophisticated strategies to navigate this dynamic landscape. Institutional investors continue to increase their allocations, propelled by regulatory clarity and the introduction of spot exchange-traded funds (ETFs). Axon Trade’s advanced solutions—such as APIs and real-time data feeds—are uniquely positioned to support hedge funds adapting to this evolving market environment.

This comprehensive review covers major developments, emerging trends, and future opportunities, offering actionable insights for industry professionals aiming to stay ahead in a competitive landscape.

Current Trends in Crypto Hedge Fund

Increasing Adoption of Digital Assets

The integration of digital assets into traditional hedge fund portfolios has surged. In 2024, 47% of hedge funds reported exposure to digital assets, compared to 37% in 2022. Regulatory clarity and the introduction of spot ETFs in key markets such as the United States and Asia have been critical drivers of this growth.

Digital asset-focused hedge funds lead the charge, with 67% planning to maintain current allocations and 33% intending to invest more by the end of the year. This shift underscores a long-term commitment to the asset class, as hedge funds align their strategies to capture the opportunities offered by digital assets.

The Shift From Spot Trading to Derivatives

Trading preferences within the hedge fund sector have evolved dramatically. Spot trading’s dominance has waned, with its share declining from 69% in 2023 to 25% in 2024. Conversely, derivatives trading surged from 38% to 58% over the same period.

Derivatives—such as futures and options—offer risk mitigation tools and enable complex strategies, making them attractive to hedge funds. This pivot reflects a more calculated approach to managing digital asset volatility, signaling the sector’s increasing sophistication.

Tokenization as a Key Growth Area

Tokenization is emerging as a transformative trend, providing hedge funds with new avenues for liquidity and market participation. Currently, 12% of digital asset hedge funds invest in tokenized assets, with an additional 33% exploring tokenization opportunities over the next year.

Tokenized assets represent traditional assets like securities or commodities on blockchain platforms, enhancing transaction efficiency and transparency. Hedge funds cite liquidity facilitation and broader investor access as key motivators for exploring tokenization.

Institutional Interest and Regulatory Shifts

Rising Institutional Participation

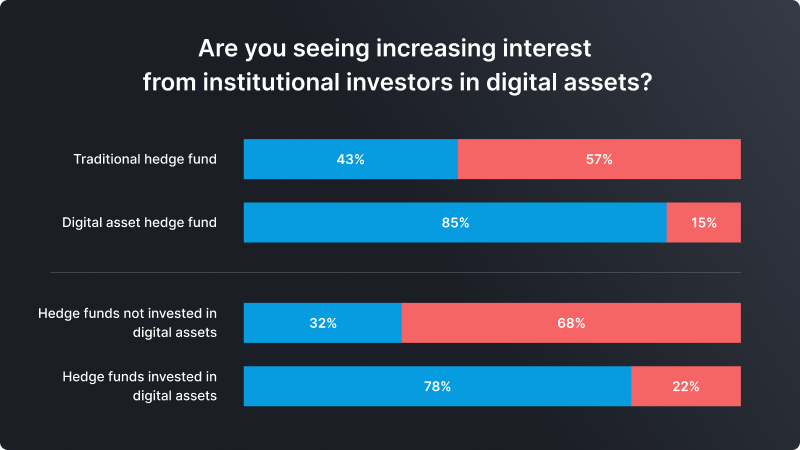

Institutional interest in digital assets has reached new heights. In 2024, 85% of digital asset hedge funds observed increased interest from institutional clients, compared to 43% for traditional hedge funds. Family offices and high-net-worth individuals remain dominant investor categories, but regulatory clarity has bolstered broader institutional confidence.

Key milestones, such as the European Union’s Markets in Crypto-Assets Regulation (MiCA) and the SEC’s approval of spot Bitcoin and Ether ETFs, have driven this momentum. These developments signal a shift toward mainstream acceptance of digital assets.

The Impact of ETFs on the Market

The SEC’s approval of spot Bitcoin ETFs in January 2024 marked a turning point. These ETFs have generated over $350 billion in trading volume, averaging $2 billion daily. Ether ETFs, introduced later, saw impressive adoption, with $6 billion in trading volume within their first week.

While 85% of digital asset hedge funds view ETFs as opportunities for innovation, traditional hedge funds have shown caution, with 66% reporting minimal impact on their strategies. This divergence highlights varying levels of engagement with digital assets.

Opportunities for Growth and Innovation

Expanding Product Offerings

ETFs have opened doors for further innovation, with potential offerings such as bi-directional levered ETFs and staking-related products. Digital asset hedge funds are particularly well-positioned to explore these opportunities, aligning with their market strategies.

The Role of Tokenization

Tokenization presents a transformative opportunity for hedge funds to reimagine traditional investment frameworks. By creating digital representations of assets, funds can unlock greater liquidity, transparency, and market participation. However, hurdles such as regulatory barriers and distribution inefficiencies remain.

Innovative applications of tokenization, including tokenized treasury products and carbon credits, are gaining traction. These developments underscore tokenization’s potential to reshape the investment landscape.

Challenges and Barriers to Wider Adoption

Regulatory Uncertainty

Despite progress, regulatory ambiguity continues to hinder adoption. Approximately 56% of digital asset hedge funds and 45% of traditional funds cite regulatory uncertainty as a primary concern. Inconsistent global standards exacerbate operational risks, deterring some players from entering the space.

Infrastructure Gaps

Infrastructure limitations present another significant challenge. Prime brokerage services, banking rails, and custody solutions are key areas requiring improvement. Industry-wide collaboration is essential to build the robust infrastructure needed for sustained growth.

How Axon Trade Supports Crypto Hedge Funds

Axon Trade provides tailored solutions to meet the demands of hedge funds operating in digital asset markets. Key offerings include:

- FIX API Access. Streamline trading across multiple exchanges, enhancing efficiency and portfolio management.

- Real-Time Market Data Feeds. Comprehensive insights for informed decision-making, featuring normalized symbology and full-depth order books.

- Order and Position Management Tools. Maintain control over trading activities and monitor distributed portfolios, even in volatile markets.

These solutions position Axon Trade as a strategic partner for hedge funds navigating the complexities of digital asset markets.

Conclusion

The crypto hedge fund industry’s transformation in 2024 is marked by rising institutional participation, regulatory advancements, and strategic innovation. Despite challenges, the sector’s growth potential remains significant.

Hedge funds looking to adapt to these dynamic markets can benefit from Axon Trade’s suite of solutions, designed to address their unique needs. From advanced trading APIs to real-time data and tokenization support, Axon Trade empowers hedge funds to thrive in an evolving landscape.